Bike Insurance in Surat

About Two Wheeler Insurance in Surat

The Silk City of India, Surat is one of the most dynamic cities the country can flaunt with one of the fastest growth rates, thanks to immigration from various part of Gujarat and other states of India. According to a report prepared by Oxford Economics, which is engaged in global forecasting and quantitative analysis, this Diamond City, called so for being the diamond processing and trading hub in Gujarat would be the world's fastest-growing city in the 2019-35 period. The city is also known for its cleanliness and greenery and claims a varied heritage of the past. In its earlier years, Surat was a glorious port with ships of more than 84 countries anchored in its harbour at any time. Even today, Surat continues the same tradition with people from across the country flocking to this industrial hub for business and jobs.

Read MoreWhy choose Liberty General Insurance for two wheeler insurance in Surat?

Hassle-free paperwork

91% claim settlement ratio (2018-19)

97+ offices all over India

4,300+ partner garages in India

Key Features

Hassle-free inspection

LGI ensures that

your bike is inspected with ease

Claim Settlement

Enjoy Hassle-free settlement with

Liberty General Insurance

Ease of Endorsement

Amend your

LGI policy with ease

Additional Protection Cover

Check our list of add-on policies

that will protect your bike

Daily Customer Service

Call us from 8 am to 8 pm,

7 days a week

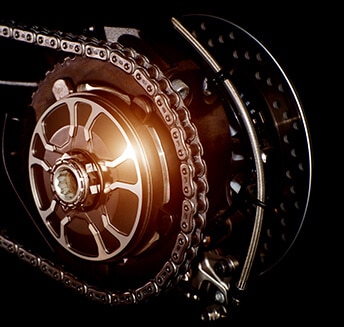

Types of Two Wheeler insurance available in Surat

Third Party Insurance

Driving without a Third Party or Liability Only insurance policy is a punishable offence under the Motor Vehicles Act of 1988. This policy, however, only covers loss or damage suffered by a third party in case of an accident arising out of the use of the insured vehicle. Remember that it does not cover any loss or damage to the insured vehicle or to the insured.

Comprehensive Insurance

As the name suggests, this is an all-inclusive policy which offers complete coverage for loss or damage to the third party as well as to you in case of theft or an accident.

Own Damage (OD) Cover

An OD or Own Damage to vehicle insurance policy covers not just accidents or theft, but also damage caused by fires, explosion or lightning, burglary or housebreaking, riots and strikes, earthquakes (fire and shock damage), typhoons or floods, riots and malicious acts, terror activity, etc.

What Own Damage Insurance does not cover for your Bike?

- Damage to third-party vehicle

- Damage to third-party property

- Injuries to other people in an accident

- Normal wear and tear

- Mechanical or electrical breakdown

- In case you use your private two wheeler commercially

- Driving under the influence of alcohol or drugs

- Driving without a licence

- Consequential loss.

Add-on covers

Liberty General Insurance also offers various add-on covers which include depreciation cover, passenger assist, consumable cover, engine safe cover, Gap value cover, key loss cover, and roadside assistance cover.

FAQs

Can I buy LGI two wheeler insurance for multiple years at one go?

Can I continue the policy in the name of the previous owner?

Can I purchase an LGI two wheeler insurance online?

Does LGI offer a depreciation cover?

Registration Number: 150 | ARN:Advt/2018/March/26 | CIN: U66000MH2010PLC209656

2019 Liberty General Insurance Ltd.

Reg Office: 10th floor, Tower A, Peninsula Business Park, Ganpat Rao Kadam Marg, Lower Parel, Mumbai - 400013

Trade Logo displayed above belongs to Liberty Mutual and used by the Liberty General Insurance Limited under license. For more details on risk factors, terms & conditions please read sales brochure carefully before concluding a sale.