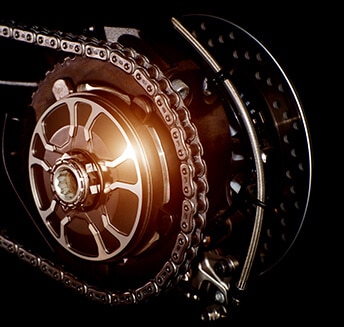

Two Wheeler Insurance in Kolkata

About Two Wheeler Insurance in Kolkata

Known to all as the City of Joy, Kolkata is India’s second-largest city, and considered by many as India’s intellectual and cultural capital. A city that has had a massive role in India’s freedom struggle, Kolkata is also the home of India’s Renaissance movement. It has long been known for its literary, artistic and revolutionary heritage. As the former capital of India, not only Kolkata, but West Bengal was the birthplace of modern Indian literary, artistic and scholastic thought.

With the good, also comes the bad. Kolkata is a metropolis with a very limited road space and one of the highest vehicle density roads. It is not a ‘'City of Joy' when it comes to road accidents, most of which involve two wheeler users.

Read MoreWhy choose Liberty General Insurance for two wheeler insurance in Kolkata?

Hassle-free paperwork

91% claim settlement ratio (2018-19)

97+ offices all over India

4,300+ partner garages in India

Key Features

Hassle-free inspection

LGI ensures that

your bike is inspected with ease

Claim Settlement

Enjoy Hassle-free settlement with

Liberty General Insurance

Ease of Endorsement

Amend your

LGI policy with ease

Additional Protection Cover

Check our list of add-on policies

that will protect your bike

Daily Customer Service

Call us from 8 am to 8 pm,

7 days a week

Types of Two Wheeler insurance available in Kolkata

Third Party Insurance

It is mandatory to have third-party insurance under the Motor Vehicle Act of 1988. Driving without it is a punishable offence under the act.

Comprehensive Insurance

A comprehensive insurance policy includes own damage to vehicle, and add-on covers, along with the third-party insurance policy

Own Damage (OD) Cover

An OD policy helps you stay covered in case of an accident or theft. This vehicle insurance policy covers damage caused by fire explosion or lightning, burglary or housebreaking or theft, riots and strikes, earthquakes (fire and shock damage), typhoons or floods, riots and malicious acts, terror activity, etc.

What Own Damage Insurance does not cover for your Bike?

- Damage to third-party vehicle

- Damage to third-party property

- Injuries to other people in an accident

- Normal wear and tear

- Mechanical or electrical breakdown

- In case you commercially use your two wheeler

- Riding your bike under the influence of alcohol or drugs

- Riding your bike without a licence

- Consequential loss.

Add-on covers

Liberty General Insurance gives you the option to choose various add-on covers such as depreciation cover, passenger assist, consumable cover, engine safe cover, Gap value cover, Key loss cover, and roadside assistance cover.

FAQs

Can I purchase a two wheeler insurance policy online?

Is it required to renew two wheeler insurance every year? Can we do it online?

Can I continue the policy in the name of the previous owner even after transferring the vehicle to my name?

Should I buy third-party or comprehensive bike insurance?

Registration Number: 150 | ARN:Advt/2018/March/26 | CIN: U66000MH2010PLC209656

2019 Liberty General Insurance Ltd.

Reg Office: 10th floor, Tower A, Peninsula Business Park, Ganpat Rao Kadam Marg, Lower Parel, Mumbai - 400013

Trade Logo displayed above belongs to Liberty Mutual and used by the Liberty General Insurance Limited under license. For more details on risk factors, terms & conditions please read sales brochure carefully before concluding a sale.