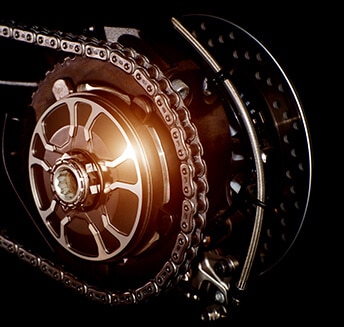

Two Wheeler Insurance in Hyderabad

About Two Wheeler Insurance in Hyderabad

Two wheelers serve at least half the Hyderabad population. Public transport modes, especially buses, which were once the most preferred mode of transport in Hyderabad, have now given way to a mushrooming number of two wheelers. It could be a bike, a scooter, moped or a scooter, this bustling city is full of them. With over 36 lakh scooters and motorcycles now on roads, the city has recorded an almost 118% increase in two wheeler numbers over 2008, when it was just around 16 lakh two wheelers.

Apart from the insufficient and inefficient public transport system, other factors too play a role in the city’s growing bike density, namely congested roads, cheaper travel, fuel efficiency, ease of parking, and end-point connectivity.

Read MoreWhy choose Liberty General Insurance for two wheeler insurance in Hyderabad?

Hassle-free paperwork

91% claim settlement ratio (2018-19)

97+ offices all over India

4,300+ partner garages in India

Key Features

Hassle-free inspection

LGI ensures that

your bike is inspected with ease

Claim Settlement

Enjoy Hassle-free settlement with

Liberty General Insurance

Ease of Endorsement

Amend your

LGI policy with ease

Additional Protection Cover

Check our list of add-on policies

that will protect your bike

Daily Customer Service

Call us from 8 am to 8 pm,

7 days a week

Types of two wheeler insurance in Hyderabad available

Third Party Insurance

A third-party insurance is compulsory as per the Motor Vehicle Act of 1988. Driving your two wheeler in Hyderabad, and other parts of the country without third-party insurance is punishable by law.

Comprehensive Insurance

A comprehensive insurance policy comprises a third-party insurance, along with an Own damage to two wheeler, as well as add-on covers.

Own damage to two wheeler

This bike insurance policy will ensure that your two wheeler is covered against damage it endures in case of accident. You are also covered in case of theft. In an own damage to two wheeler policy, you are covered for the following:

- by fire explosion self-ignition or lightning

- by burglary housebreaking or theft

- by riot and strike

- by earthquake (fire and shock damage)

- by flood typhoon hurricane storm tempest inundation cyclone hailstorm frost

- by accidental external means

- by malicious act

- by terrorist activity

- whilst in transit by road rail inland-waterway lift elevator or air

- by landslide rockslide

What own damage does not cover

- Damage to third-party vehicle

- Damage to third-party property

- Injuries to other people in an accident

- Normal wear and tear

- Mechanical or electrical breakdown

- In case you use your private two wheeler commercially

- Driving under the influence of alcohol or drugs

- Driving without a licence

- Consequential loss

Add-on covers

Liberty General Insurance gives you the option to choose various add-on covers these include

- Depreciation cover

- Passenger assist

- Consumable cover

- Engine safe cover

- Key loss cover

- Roadside assistance cover

FAQs

How do I make any change in LGI policy?

How do I buy two wheeler insurance?

Does LGI offer a depreciation cover?

How do I renew my two wheeler insurance policy for a bike in Hyderabad?

Registration Number: 150 | ARN:Advt/2018/March/26 | CIN: U66000MH2010PLC209656

2019 Liberty General Insurance Ltd.

Reg Office: 10th floor, Tower A, Peninsula Business Park, Ganpat Rao Kadam Marg, Lower Parel, Mumbai - 400013

Trade Logo displayed above belongs to Liberty Mutual and used by the Liberty General Insurance Limited under license. For more details on risk factors, terms & conditions please read sales brochure carefully before concluding a sale.