Two Wheeler Insurance for TVS

About TVS

TVS is synonymous with the best scooters in business. If you just bought one, don’t forget to buy two wheeler insurance for your TVS two wheeler. Liberty General insurance (LGI) gives you the option to get a comprehensive two wheeler insurance policy.

TVS Motor Company is the third largest motorcycle manufacturer in India with its headquarters in Chennai. It has an annual sale of 3 million units, with an annual capacity of 4 million vehicles. The company is also responsible for exporting its products to over 60 countries, making it the second largest exporter in India. The TVS Motor Company Ltd. is the largest in the TVS group in terms of size and turnover.

Read MoreWhy choose Liberty General Insurance for your TVS bikes?

Hassle-free paperwork

91% claim settlement ratio (2018-19)

97+ offices all over India

4,300+ partner garages in India

Top TVS two wheelers

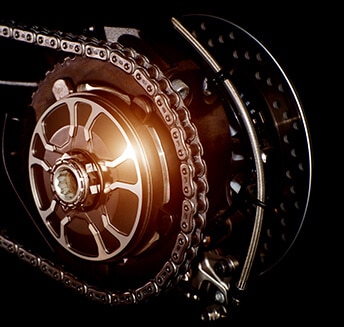

TVS Apache RR310

This bike is known for its 310cc single cylinder, liquid-cooled, fuel-injected engine. The bike is capable of producing a maximum torque of 34bhp and 27Nm. Apache 310 comes with a 300mm front disc and a 240mm rear disc brakes with dual-channel ABS.

TVS Jupiter

This 110 cc scooter is one of the most commonly found ones on Indian roads. It comes with a 109cc air-cooled single-cylinder engine that can churn a maximum torque of 7.8bhp and 8Nm. It is one of the top selling scooters from the TVS Motors stable.

TVS Scooty Zest

TVS Motors’ Scooty is one of the pioneering models of scooters in India. The scooter has gone through numerous transitions and has remained a favourite among commuters. The Zest model is an upgrade to the Scooty Pep Plus and Streak and comes with a 110 cc engine.

Key Features

Hassle-free inspection

LGI ensures that

your bike is inspected with ease

Claim Settlement

Enjoy Hassle-free settlement with

Liberty General Insurance

Ease of Endorsement

Amend your

LGI policy with ease

Additional Protection Cover

Check our list of add-on policies

that will protect your bike

Daily Customer Service

Call us from 8 am to 8 pm,

7 days a week

Types of two wheeler insurance for TVS bikes

Liberty General Insurance offers two types of two wheeler insurances:

Own damage to two wheeler

This policy covers you against any financial liabilities arising out of damages caused to you and your two wheeler in case of an accident. It covers you against the theft of your two wheeler. Another thing that you will be protected against is the medical expense for treatment of your injury and expenses for repairing/ replacing parts of the two wheeler.

What does own damage to two wheeler insurance policy not cover?

When opting for an own damage two wheeler insurance policy, you must be aware of what benefits you’re missing out on. Let’s take a look at what this policy does not cover:

- Damages to a third party vehicle (If you want coverage for both - own as well as third party damages then buy comprehensive bike insurance)

- Damage caused to a third-party property

- Injuries caused to other people in an accident

- Normal wear-and-tear of the vehicle

- Mechanical and electrical breakdown

- A vehicle being used other than in accordance with the limitations as to use. For example, if you use your two wheeler for commercial purposes.

- Damage to/by person driving without a valid driving license

- Loss or damage caused while riding under the influence of alcohol or any other intoxicating substance

- Consequential loss - if the original damage causes subsequent damage/loss, only the original damage will be covered

Third party Insurance

A third party insurance is one that covers you against financial liabilities for repair of damage caused to any third party. It includes repair of a third party vehicle or property damaged in an accident involving your bike. The policy also covers medical expenses for treatment of injuries caused to a third party. Under the Motor Vehicles Act of 1988, it is mandatory for every two wheeler owner to have a third party insurance, riding without which is a criminal offence.

Add-on covers

Liberty General Insurance allows you to add extra benefits to your insurance cover. They are called add-ons. Some add-ons available to you are:

- Depreciation cover

- Passenger assist

- Consumable cover

- Engine safe cover

- Key loss cover

- Roadside assistance cover

FAQs

What are the documents required to get a two wheeler insurance?

Should I buy third-party or comprehensive bike insurance?

What is depreciation cover in bike insurance?

How to get bike insurance quotes?

Registration Number: 150 | ARN:Advt/2018/March/26 | CIN: U66000MH2010PLC209656

2019 Liberty General Insurance Ltd.

Reg Office: 10th floor, Tower A, Peninsula Business Park, Ganpat Rao Kadam Marg, Lower Parel, Mumbai - 400013

Trade Logo displayed above belongs to Liberty Mutual and used by the Liberty General Insurance Limited under license. For more details on risk factors, terms & conditions please read sales brochure carefully before concluding a sale.