Two Wheeler Insurance for Mahindra & Mahindra

About Mahindra & Mahindra

For a sturdy two wheeler, indigenous automobile giant Mahindra & Mahindra has a range of bikes on offer. If you are planning to own one, remember to protect your two wheeler from damages with a two wheeler insurance policy by Liberty General Insurance (LGI).

Mahindra & Mahindra Two Wheelers Division is a subsidiary of the Mahindra and Mahindra group, a USD 19 million global conglomerate. Mahindra has recently entered the two wheeler segment with the goal of expanding its customer base. Among the first offerings was the Mahindra Gusto, which is a 125CC scooter with segment-leading features. These include Height Adjustable Seat, Anti-Theft Alarm with Engine Immobiliser, Find Me Lamps and Remote Flip Key among others. Mahindra also launched the Mojo, which is a Bajaj Dominar competing touring motorcycle.

Read MoreWhy choose Liberty General Insurance for your Mahindra & Mahindra bikes?

Hassle-free paperwork

91% claim settlement ratio (2018-19)

97+ offices all over India

4,300+ partner garages in India

Top Mahindra & Mahindra two wheelers

Mahindra Mojo

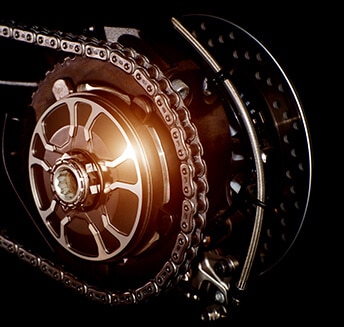

Mahindra Mojo is now available in two variants. The XT300 is the latest and upgraded version of the Mojo UT300. The XT300 is ideal for cruising long distances and is aimed to appease the cruiser bike market in India.

Mahindra Gusto

The Mahindra Gusto comes in two variants—the VX and the DX. It comes with an 110cc single-cylinder engine that is capable of delivering a torque of 8bhp and 9Nm. It also sports tubeless tyres that are suspended from telescopic forks in the front and a monoshock at the rear.

Key Features

Hassle-free inspection

LGI ensures that

your bike is inspected with ease

Claim Settlement

Enjoy Hassle-free settlement with

Liberty General Insurance

Ease of Endorsement

Amend your

LGI policy with ease

Additional Protection Cover

Check our list of add-on policies

that will protect your bike

Daily Customer Service

Call us from 8 am to 8 pm,

7 days a week

Types of two wheeler insurance for Mahindra and Mahindra bikes

Liberty General Insurance offers two types of two wheeler insurances:

Own damage to two wheeler

Under this policy, we cover you and your vehicle against any expenses that arise when your two wheeler has been in an accident or has been stolen. This policy includes expenses for medical treatment of injuries caused to you in the accident. It also covers expenses for repairing or replacing parts of your damaged two wheeler.

What Own Damage Insurance will not cover for the two wheeler?

- Damages to a third party vehicle (If you want coverage for both - own as well as third party damages then buy comprehensive bike insurance)

- Damage caused to a third-party property

- Injuries caused to other people in an accident

- Normal wear-and-tear of the vehicle

- Mechanical and electrical breakdown

- A vehicle being used other than in accordance with the limitations as to use. For example, if you use your two wheeler for commercial purposes.

- Damage to/by person driving without a valid driving license

- Loss or damage caused while riding under the influence of alcohol or any other intoxicating substance

- Consequential loss - if the original damage causes subsequent damage/loss, only the original damage will be covered

Third party Insurance

A third party insurance is one that protects you against expenses to cover damages caused to a third party in an accident involving your two wheeler. The expenses could be for medical treatment of injury to third party or repair of damages to third party property. Under the Motor Vehicles Act of 1988, it is mandatory to have a third-party insurance to drive on Indian roads. Driving without a third party insurance is a criminal offence.

Add-on covers

Liberty General Insurance allows you to add extra benefits to your insurance cover. They are called add-ons. Some add-ons available to you are:

- Depreciation cover

- Passenger assist

- Consumable cover

- Engine safe cover

- Key loss cover

- Roadside assistance cover

FAQs

What does a two wheeler insurance cover?

How can I buy a LGI two wheeler insurance policy online?

Should I buy third-party or comprehensive bike insurance?

What are the factors that affect two wheeler insurance policy premiums?

Registration Number: 150 | ARN:Advt/2018/March/26 | CIN: U66000MH2010PLC209656

2019 Liberty General Insurance Ltd.

Reg Office: 10th floor, Tower A, Peninsula Business Park, Ganpat Rao Kadam Marg, Lower Parel, Mumbai - 400013

Trade Logo displayed above belongs to Liberty Mutual and used by the Liberty General Insurance Limited under license. For more details on risk factors, terms & conditions please read sales brochure carefully before concluding a sale.