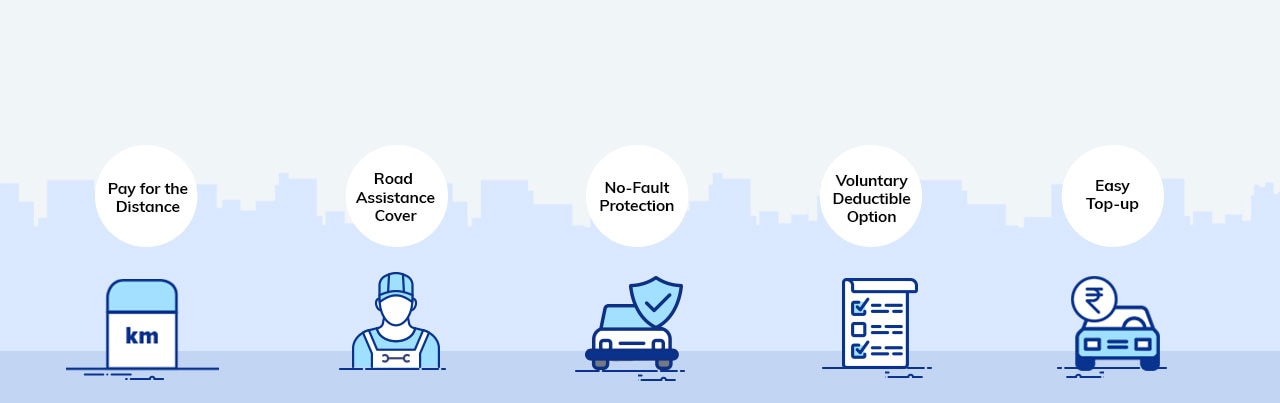

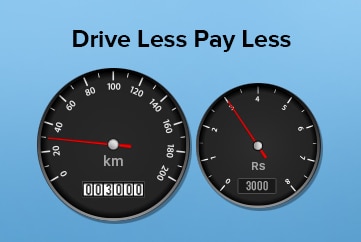

If you could buy a car insurance policy based on the distance you travel rather than for a specific time, would you opt for it? Liberty General Insurance now offers ‘Pay for the Distance’, which is bundled with a host of other innovative features, under its existing Private Car Package Policy. This usage-based car insurance ensures that you pay a lower premium if you don’t use your vehicle all that much.

Liberty General Insurance has always been at the forefront of innovation – constantly launching new products and features – that makes life easier for car owners. 'Pay for the Distance’ insurance is an idea whose time has come, and we are happy that we are one of those selected to pilot the feature. ‘Pay for the Distance’, along with the host of other features that are launching, will certainly find a lot of takers and make car insurance cheaper for those who don’t use their vehicles as much as others.

The cost of your insurance is based on a usage-based car insurance policy. So, if you don’t use your car much during a year, you can pay a lower premium.

The new bundle of features includes additional voluntary deductibles in return for discounts on the own damage portion of the premium

This feature will enable policyholders to get No Claim Bonus at the time of policy renewal, even if there is any loss or damage -- either to the parked insured vehicle’s windshield glass by an external object, or if the loss is due to flood, earthquake or an Act of God to the parked insured vehicle.Damage to only windshield glass to the parked insured vehicle and loss due to flood/ earthquake/ Act of god to the parked insured vehicle.

The insurance package offers roadside assistant as an inbuilt feature

While making the purchase, you can choose the maximum kilometre coverage you want to opt for. If you don’t take your vehicle out much, you can opt for a lower coverage. Of course, you have the option of topping up your coverage – by buying an additional number of kilometres if you feel you will exceed your existing coverage.

Third-Party insurance cover, which is compulsory, will be valid throughout the policy period irrespective of the kilometres declared by the customer.

Policyholders can avail of additional voluntary deductibles in return for discounts on the Own Damage portion of the premium.

Roadside Assistance Cover will be available to the insured as an inbuilt feature. Services under this cover include:

You can use these services for a maximum two times during the policy period.

Inbuilt Roadside Assistance Cover will not include additional expenses regarding replacement of a part, additional fuel and any other service which does not form part of the standard services mentioned above

Road Assistance Services will be offered within a radius of 50 km from the place of breakdown to nearest available vendor/repairer

Under the No-fault Protection feature, you are allowed the No Claim Bonus at the time of renewal of the policy despite claiming loss or damage under the following conditions:

This bundle of features will be offered only to customers purchasing the policy directly from the company through the online channel.

Answer.Actual kilometre usage during the policy tenure shall be calculated as the difference between the kilometre reading as per the odometer of the vehicle on the date of loss and the kilometre reading as per the odometer of the car on the date of proposal.

Answer. No, this option is available only to customers who are purchasing directly from the company through our online channel.

Answer. No, the third-party cover will be for a year, irrespective of the distance covered. It will continue to be in force even if you have exhausted all the kilometres under the Own Damage portion of the insurance policy.

Thanks Manish

Dear Mr. Dharma – I would like to thank your company personnel at the customer services division for their excellent support. Your customer care executive, Manish Bhatia took care of all my queries in a very courteous and professional manner.

Would also like to thank Mr. R Rajkiran from ‘Invee Intelligence Private Limited’ and Mr. Umesh for taking this issue to closure.

Keep up the good work.

Majid Hashmat

Lorem ipsum dolor ame consectetur adipiscing Cras feugiat nislplacerat imperdiet Cra eget scelerisque Suspendise potenti Nulla tincidunt dui Vestibulum ultricies odio facilisis non rutrummaximus Fusce.

Mr. N. Rama Mohan Rao

Average RatingBased on 35 Ratings

7/16/2016 10:51:28 AM

Category: General Insurance

hi. ashish singal, 09700616177 there is not at all good response from ur company.my policy no. is 20000365156..

7/16/2016 10:51:28 AM

Category: General Insurance

A good company to insure with. Quick customer service and claims also. Really feeling happy to insure with LVGI.

7/16/2016 10:51:28 AM

Category: General Insurance

customer satisfaction is the key to competency Have got a good feedback regarding the service.I hope we get to avail the services soon in dehradun...

7/16/2016 10:51:28 AM

Category: General Insurance

I am happy to see that being a small company the employees talk to each other & resolve customer queries fast. I am pleased with the speed of service. Very professional people...

7/16/2016 10:51:28 AM

Category: General Insurance

I was surprised to see the level of professionalism shown by the claims & customer service team. They were quick and courteous. Cheers...

When it comes to vehicle insurance, most of us tend to overlook this necessity. Even a minor accident can lead to considerable expenses ...

Read More

Although car insurance is mandatory, most car owners don�t have valid insurance covers for their vehicles..

Read More

Other than the fact that you need to have a car insurance policy to legally drive your car on Indian roads, there are various other reasons...

Read More

Irrespective of the weather conditions, car owners who are particular about their vehicles prefer to drive their cars every day. Not only this...

Read MoreRegistration Number: 150 | ARN:Advt/2018/March/26 | CIN: U66000MH2010PLC209656

2019 Liberty General Insurance Ltd.

Reg Office: 10th floor, Tower A, Peninsula Business Park, Ganpat Rao Kadam Marg, Lower Parel, Mumbai - 400013

Trade Logo displayed above belongs to Liberty Mutual and used by the Liberty General Insurance Limited under license. For more details on risk factors, terms & conditions please read sales brochure carefully before concluding a sale.